3 Ways Artificial Intelligence Can Supplement the Finance Dept

By Eric Dowdell

Former Head of Finance Solutions Business

Dun & Bradstreet

18 February 2019

Artificial Intelligence and Machine Learning for Modern Finance

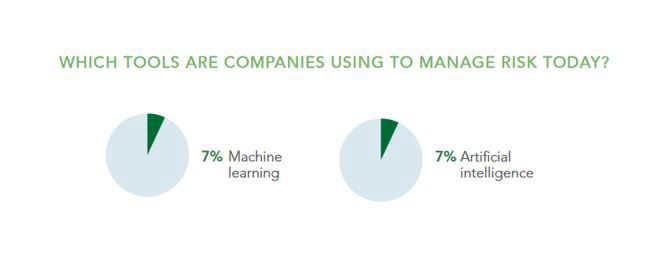

A scant six months ago, I wrote about our “ability to combine human ingenuity with the benefits of machines— artificial and natural intelligences uniting” in The Gray Leap. Since then, there’s been no shortage of headlines showcasing companies’ efforts to harness artificial intelligence (AI) and machine learning (ML) to improve their business and, possibly, change the way we all do business. Yet while the technology exists, adoption by the masses can be slow. Our recent study found that fewer than 10% of companies are using AI and ML to manage risk.

There are those of you who may be thinking, “Isn’t artificial intelligence about taking away human-centered jobs, since a computer can be programmed to do what people can in a fraction of the time?” Well, while it’s true that some people are skeptical and wary of AI and ML for that very reason, frankly, their fears are quite unfounded. In fact, a recent Dun & Bradstreet survey of attendees at AI World Conference and Expo found that 40% of respondents’ organizations are adding more jobs as a result of deploying AI.

Many manufacturing and service industries around the world are using AI and ML with zero threat to replacing humans on the job. According to HBR, they are utilizing AI frequently to enhance established computer-to-computer activities, but not human responsibilities. Every day, more companies are discovering that these transactions, the ones already being conducted by computers and machines, can be further strengthened with AI. For example, Forbes reports that Landing AI has developed a tool that can detect microscopic defects in products on the assembly line, in order to assist human inspectors with quality assurance, not replace them. Called Landing Light, it uses AI “trained on remarkably small volumes of sample images” to see, and then learn, where flaws exist that a person can’t see.

How AI and ML Help Finance Leaders

Now, when we turn our attention to the finance leader’s current landscape, we can see that he or she needs to make calculated decisions that affect hundreds across the enterprise. These decisions rely on information from computers to create enterprise success. If their goal is to empower employees to do their best work and lead the company to growth and success, then partnering with machines, not running from them, is the right choice.

Finance leaders have access to more data than ever before, and companies that deploy automated technologies can realize substantial performance gains and take the lead in their industries. Big data, plus high-speed computing, plus artificial intelligence, equals a new potential for success for finance leaders, who are now evolving to add cutting-edge technology to their repertoire. With that in mind, let’s look at three distinct ways that finance leaders can utilize AI and ML to supplement their teams’ skills.

1. Calculate Financial Risk

The first way that AI and ML can help is in assessing and scoring partnerships for financial risk. These are situations in which a finance leader is asked to evaluate a partner’s potential to be a jumpstart or a detriment to their company’s financial health. As Bloomberg states, “The ability of machine learning models to analyze large amounts of both financial and non-financial data – with more granularity and more in-depth analysis – can improve analytical capabilities in risk management.” For example, Dun & Bradstreet’s newest fraud score uses ML to identify businesses that never intend to pay. Because machines can score and rescore faster, not just based on a few criteria, but hundreds, they can continually evaluate companies and find trends much faster than the old way. In the process, machines will also create fewer errors and present far fewer false positives. Using these highly accurate, AI-powered scores can help financial leaders make better decisions about which companies their business should be doing business with.

2. Collaborate with Stakeholders

Secondly, in today’s world, we know that speed is everything. More than collecting and sorting data coming into the digital ecosystem, AI and ML technologies can be a catalyst for enhancing the finance department’s partnership with the rest of the enterprise. Indeed, AI can be leveraged internally to validate the choices being made by and between certain departments. There are many different inputs from many different disciplines that go into making determinations and business decisions. AI is central to synthesize and distill the various inputs, help guide the organization to better decisions, and ultimately contribute to a problem-solving network. Essentially, AI can answer the question, did that decision help us move forward? This type of confirmation results in its ability to reaffirm the choices made by leadership. Thus, the more faith the rest of the enterprise has in the leadership’s decisions, the more expanded the finance team’s roles can become. This can result in the growth of the finance leader’s influence on the success of the company. With more influence, more decisions can be made geared toward strategic decisions that move the company forward – faster.

3. Anticipate Customer Needs

Thirdly, and finally, AI and ML can help finance teams develop a richer understanding of their customers. By delivering more robust customer portfolio analytics, and providing information that is accurate and updated automatically, AI gives finance leaders better insight into customer usage and experience. Because finance teams often have access to data linked to customer behavior (think of usage and purchasing found in back office systems), they can identify opportunities and partner with other functional areas to drive sales. Similarly, Netflix has been successful in leveraging AI to understand its customers and create a personalized experience in return, which makes good business sense. The company documents usage and its algorithms make recommendations to keep customers watching, which generates loyalty and secures retention in time for renewal. As the enterprise leverages AI to develop products that anticipate customer needs, the finance team spearheads strategy surrounding which opportunities to pursue. Other organizations should take note – AI can enable faster and larger-scale evidence-based decision-making, insight generation, and process optimization. So, instead of worrying about machines replacing humans, remember this: AI gives today’s finance leaders a competitive advantage that is as real as it gets.

Related

Connect with us

Questions or Problems? Let us help.