ASEAN SME Transformation Study 2020

The Editors

17 July 2020

Are you ready to turn today's challenges into opportunities?

1,000 regional SMEs share how they are responding to COVID19 and becoming future-ready.

The start of the new decade has brought about significant challenges for ASEAN’s small- and medium-sized enterprises (SMEs)

Already having to cope with headwinds from geopolitical uncertainties, SMEs are now grappling with the unprecedented economic, business and social impact of the COVID-19 pandemic. As a result, global growth has contracted sharply and many SMEs are struggling to stay afloat in these challenging times.

To help SMEs see through to calmer waters, governments and financial institutions in ASEAN are offering lifelines to SMEs in the form of grants, loans at reduced interest rates and wage support schemes. Other stakeholders in the business ecosystem, from industry associations, banks to technology firms, have also stepped up to help SMEs navigate through the uncertainties. Although managing cash flow is the immediate priority for many SMEs as they cope with the disruption to their business from COVID-19, it is imperative that SMEs continue to deepen their capabilities so that they emerge from COVID-19 stronger. While some business plans have taken a back seat while SMEs manage immediate priorities, many ASEAN SMEs are using the current turmoil to ensure their long-term competitiveness and to be ready to capitalise on the economic recovery post-pandemic.

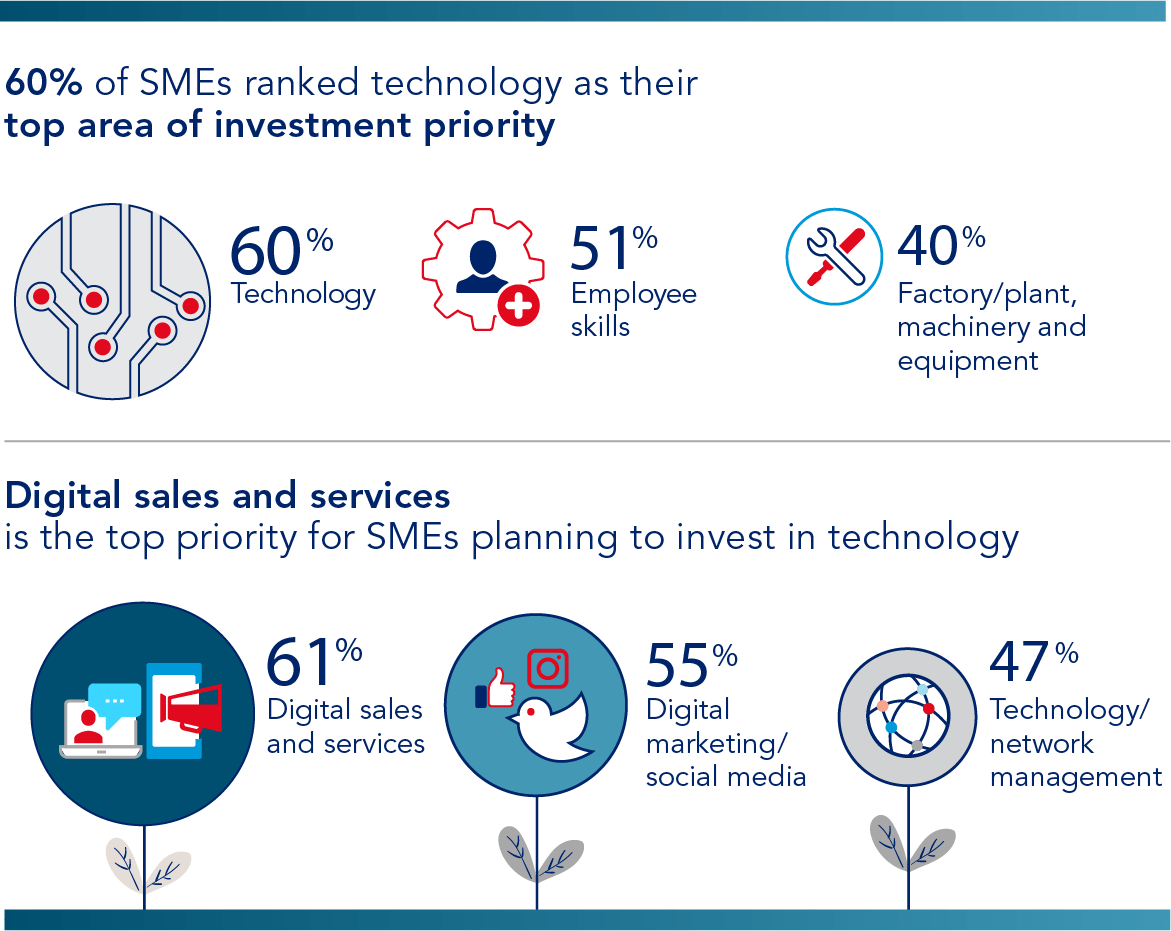

As such, ASEAN SMEs are focusing their attention on digital transformation as a way to drive online revenue streams amid COVID-19. While it may seem counterintuitive to carry out transformation initiatives amid such uncertain economic conditions, doing so will help position them for the digital future – where technology has reshaped ways in which businesses and individuals operate, work, live and play.

To help ASEAN SMEs gain insight into the strategies their peers are taking to ensure the survival of their business as they contend with COVID-19 concerns, United Overseas Bank (UOB), Accenture and Dun & Bradstreet (D&B) have collaborated on the ASEAN SME Transformation Study 2020. Here is a glimpse into the key trends in Singapore:

SMEs across five key ASEAN countries — Indonesia, Malaysia, Singapore, Thailand and Vietnam — were surveyed. The insights were gained from two surveys with 1,000 SMEs conducted before and during the COVID-19 pandemic. The report explores other areas including the relationships between SMEs and their banks as well as their preferred sources of financing. It also identifies potential opportunities for ASEAN SMEs to help them prepare for economic recovery. SMEs comprise at least 97 per cent of businesses across ASEAN and are the region’s growth engine. As their operations resume post-COVID-19, we hope that the insights in this report provide a helpful guide as they make long-term plans to seize businesses opportunities and to achieve sustainable growth. We look forward to continue supporting ASEAN’s SMEs and to help them realise their growth ambitions.